Development Strategy: the added value of comprehensive Development Plans

Challenging Early-Stage Fundraising Environment Requires a Change in Thinking

Clinical Development Plans (CDPs) are developed using multidisciplinary expertise. Early input from clinical development experts with the relevant therapy area and platform experience ensures that the trials proposed are innovative, realistic and operationalizable, delivering the maximum value possible using the most relevant and meaningful endpoints to inform the TPP and maximize the probability of success. This blog discusses Adnovate’s approach to CDP creation and its value in drug development.

The average overall costs of bringing a drug to market have increased substantially in the past decade to $4.5-5B1 taking around 9-10 years2. Particularly relevant for early-stage companies, the cost of Phase 1 studies has risen markedly and is now on average > $5M for an asset in development for an oncology indication. In parallel, the composite success rate (overall probability of an asset that enters Phase 1 gaining marketing approval) has decreased to only 6.3%, and success through Phase 1 has fallen to an all-time low of 39%3. With these considerations and the current macroeconomic environment in mind, funding for early-stage companies has become far more challenging and the investment community is now looking to reduce their risk, becoming increasingly selective in its deployment of capital.

The production of a differentiated target product profile (TPP) developed in the context of future unmet medical need and likely product positioning is far more likely to assure investors of sufficient future value creation worthy of investment than merely demonstrating efficacy and safety during non-clinical and early clinical development.

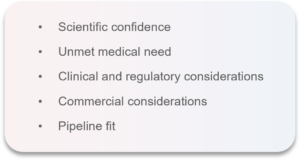

Careful choice of indication is a key step that precedes TPP development. A holistic assessment of possible and preferred indications allows an objective decision to be made on the optimal condition and (sub)population in which to develop an asset. Indication Prioritization is covered in a separate blog here on the Adnovate Clinical website and includes a comprehensive landscape assessment. Indication prioritization takes into account a variety of aspects including:

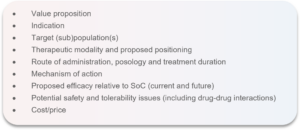

Using outputs from the indication prioritization exercise, notably the landscape assessment, a TPP can be generated. The TPP outlines the key characteristics of a product as outlined below, enabling the creation of well-informed, risk-managed development plans, both clinical and non-clinical and is covered in a separate blog.

In the current tightly-constrained funding environment, carefully thought out Development Plans with cross-functional expert considerations is needed. A Development Plan built on the foundation of an attractive TPP that evaluates the differentiated positioning and unmet need using the proposed approach in the context of the SoC at projected time of launch will be well received by investors.

TPPs and Development Plans incorporating this level of thinking will foster scientific and commercial credibility thus increasing the likelihood of successful funding and generating the potential for maximizing value creation.

The Development Plan

The Clinical Development Plan (CDP)

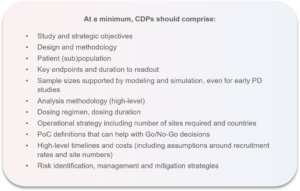

With the basics of the TPP in place, the generation of development plans can begin in parallel, starting with the early clinical study options. The clinical trials undertaken during an asset’s development are costly, take time and will shape financial and resourcing requirements for the company. Thus, the most suitable designs to meet TPP objectives and accurately estimate costs will be needed to support fundraising and the timelines promised for value delivery. These will need to pass the scrutiny of diligence activities carried out by investors, so they must be accurate and their components justifiable.

In the startup biotech environment, especially where approaches are at the research or early non-clinical stage, Development Plans and the background materials that support them are often produced more superficially due to capital and human resource constraints. In this case there is little focus on future clinical development and teams may not incorporate the assessment of the added long-term value that comes from considering market positioning, patient access and the reimbursement landscape: this undermines the ability to accurately estimate early product valuations.

A TPP taking these factors into account and a comprehensive Development Plan aligning with that TPP allows for clearer assessment of the asset’s economic viability and makes it significantly more attractive for assessing investment potential.

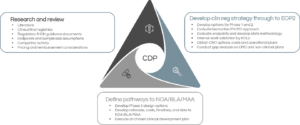

Non-clinical and clinical plans assess, in a stepwise manner, the practical feasibility of achieving the chosen TPP, by showing how data will be generated to support the proposed claims and to demonstrate a differentiated profile. As such, the creation of the TPP and Development Plan are often best conducted in parallel.

CDPs are developed using multidisciplinary expertise. Early input from clinical development experts with the relevant therapy area and platform experience ensures that the trials proposed are innovative, realistic and operationalizable, delivering the maximum value possible using the most relevant and meaningful endpoints to inform the TPP and maximize the probability of success. Regulatory input at this stage ensures that the CDP aligns with relevant agency requirements.

The CDP contains information from Phase 1 through the client’s desired point of focus (e.g. end of Phase 1, proof of mechanism, proof of concept (PoC), approval, etc.), supported by detailed rationale.

In order to identify the best clinical strategy for a company, it is advisable to consider a number of potential CDP options and compare timelines, costs and the data derived from individual and a combination of clinical trials. These might include the addition of Phase 1b patient cohorts onto standard healthy volunteer SAD/MAD studies, seamless Phase 1/2 combined designs, combined Phase 2/3 designs and Bayesian designs across all phases of development. For assets under development in oncology, special attention should be given to the requirements and implications of Project Optimus.

Once a preferred CDP has been decided upon, advice can be canvassed from a number of Clinical Research Organizations (CROs) to confirm costings and timelines based on real-world recruitment experiences (e.g. viable numbers of sites and prior recruitment rates in studies with similar populations).

The Non-clinical Development Plan

Preclinical studies during drug development are designed to identify candidate compounds with suitable efficacy and safety profiles to provide the greatest possibility of successful clinical progression. However, in the current funding environment, this process is often minimized and streamlined. Ideally an independent expert panel review of the preclinical package is advantageous to identify non-clinical studies to support early clinical development.

In particular, often after early clinical review and development planning, a TPP may be refined, necessitating further validation and characterization of the drug candidate to align the data package with both scientific rationale and regulatory requirements, thus enabling a straightforward transition through the clinical approval process. In addition, clinical KOL review often highlights issues around treatment requirements in combination with SoC, competitor drugs, routes of administration (especially relevant to critical care) and specific safety considerations: non-clinical studies may need to be designed to address these issues and support progression. The use of in-silico modelling and bioinformatics may also be considered to address specific issues. Early identification of these non-clinical studies prevents issues which might cause delays in later clinical development

Additionally, review by an experienced panel of drug development experts gives added confidence to ensure non-clinical and CMC studies meet all GLP and GMP regulatory requirements and that safety and toxicology/ADME data are suitable for registration and early clinical development. Many of these requirements are specific to individual regulatory organizations and institutes.

Finally, biomarkers are an integral part of early clinical development planning, often highlighting the need for further non-clinical studies specific to the early-phase clinical plan. Biomarker development may require the specialized methodological development. Indeed, non-clinical studies may indicate the need for additional Phase 0 clinical studies to increase the chances of success in Phase 1.

Conclusions

A Development Plan that supports a well-thought-out TPP is essential for regulatory and commercial success in drug development. These documents also clarify risk, cost, and timelines and give a clear roadmap for investment milestones, with the probability of success giving confidence to potential investors. A comprehensive development package combined with a competitive but realistic TPP allows potential investors to fully appreciate the future value of an asset, increasing confidence and the likelihood of a successful funding raise.

Partnering with a consultancy that can provide relevant deep expertise to supplement the knowledge of a client’s internal team and conduct a detailed landscape assessment will result in the development of a future-proofed and evidence-based TPP leading to a Development Plan supporting its claims, with clear Go/No-Go stage gates to maximize the chances of successful funding.

Adnovate Clinical’s highly experienced multidisciplinary teams include translational, preclinical, CMC, clinical development, operational, regulatory, market access and therapeutic area experts. Bespoke teams are assembled per project to produce high-quality TPPs, CDPs and supporting non-clinical and CMC plans that meet the unique needs of each client. These take into account budgetary constraints, adopting a customized approach to maximize the chances of clearing regulatory hurdles and providing clear visualization to address future unmet needs and commercial success. Our teams also select and oversee vendors, including clinical and non-clinical CROs.

By taking a ‘skin in the game’ approach to fundraising interactions, the Adnovate Clinical team remains on hand to defend the recommended approaches during pitches and due diligence activities, giving management teams access to the expertise they need to convey credibility to future investors.

For more information, please get in touch at: https://www.adnovateclinical.com/contact-us/

References

- Roche R&D presentation September 2023. Roche analysis of EvaluatePharma (data as of March 2023). Note, new molecular entities, including biologics.

- Roche R&D presentation September 2023. Note includes Phase 1b expansions for oncology, single arm Phase 2 and randomized Phase 2 studies.

- Global trends in R&D report, February 2023.

;)