Development Strategy: the added value of a well-thought-out Target Product Profile

Challenging Early-Stage Fundraising Environment Requires a Change in Thinking

In the current tightly-constrained funding environment, a carefully thought out TPP created utilizing cross-functional expert input that details the differentiated positioning of a proposed approach in the context of future SoC and clearly outlines how it will aim to address unmet needs at the projected time of launch will be well-received by investors. This blog discusses Adnovate’s approach to TPP creation and its value in fundraising and drug development.

The average overall costs of bringing a drug to market have increased substantially in the past decade to $4.5-5B1 taking around 9-10 years2. Particularly relevant for early-stage companies, the cost of a Phase 1 study has risen markedly and is now on average > $5M for an asset in development for an oncology indication. In parallel, the composite success rate (overall probability of an asset that enters Phase 1 gaining marketing approval) has decreased to only 6.3%, and success through Phase 1 has fallen to an all-time low of 39%3. With these considerations and the current macroeconomic environment in mind, funding for early-stage companies has become far more challenging and the investment community is now looking to reduce their risk, becoming increasingly selective in its deployment of capital.

Demonstrating only efficacy and safety during non-clinical and early clinical development, without considering product positioning and a differentiated target product profile (TPP) in the context of the future unmet medical need, is unlikely to assure investors of sufficient future value creation worthy of investment.

Careful choice of indication is a key step that precedes TPP development through an Indication Prioritization exercise. A holistic assessment of possible and preferred indications allows an objective decision to be made on the optimal condition and (sub)population in which to develop an asset. Indication Prioritization is covered in a separate blog here on the Adnovate Clinical website and should include a comprehensive landscape assessment and take into account multiple factors, including:

In the current tightly-constrained funding environment, a carefully thought out TPP created utilizing cross-functional expert input that details the differentiated positioning of a proposed approach in the context of future SoC and clearly outlines how it will aim to address unmet needs at the projected time of launch will be well-received by investors. This is now more than ever an exercise worth conducting in a detailed way even at the early stages of the non-clinical development cycle.

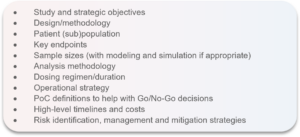

Development plans can then be generated in parallel with the TPP in order to demonstrate product attributes and a competitive profile in a stepwise manner. The production of Development Plans is also covered in a separate Adnovate Clinical blog. Among other aspects, development plans should cover:

With outlines of the early clinical plans in hand, the exact non-clinical and CMC requirements supporting entry into clinic from a regulatory and scientific perspective can be ascertained.

TPPs and development plans incorporating a deep level of thinking will foster scientific and commercial credibility, increasing the likelihood of successful funding and generating the potential to maximize value creation.

The TPP

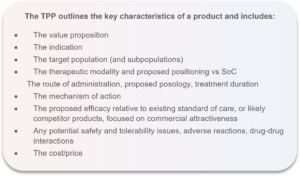

The TPP is a living document that is adapted throughout the product lifecycle as new data emerges about the product and disease area. It guides development activities and eventually forms the backbone of the approved label.

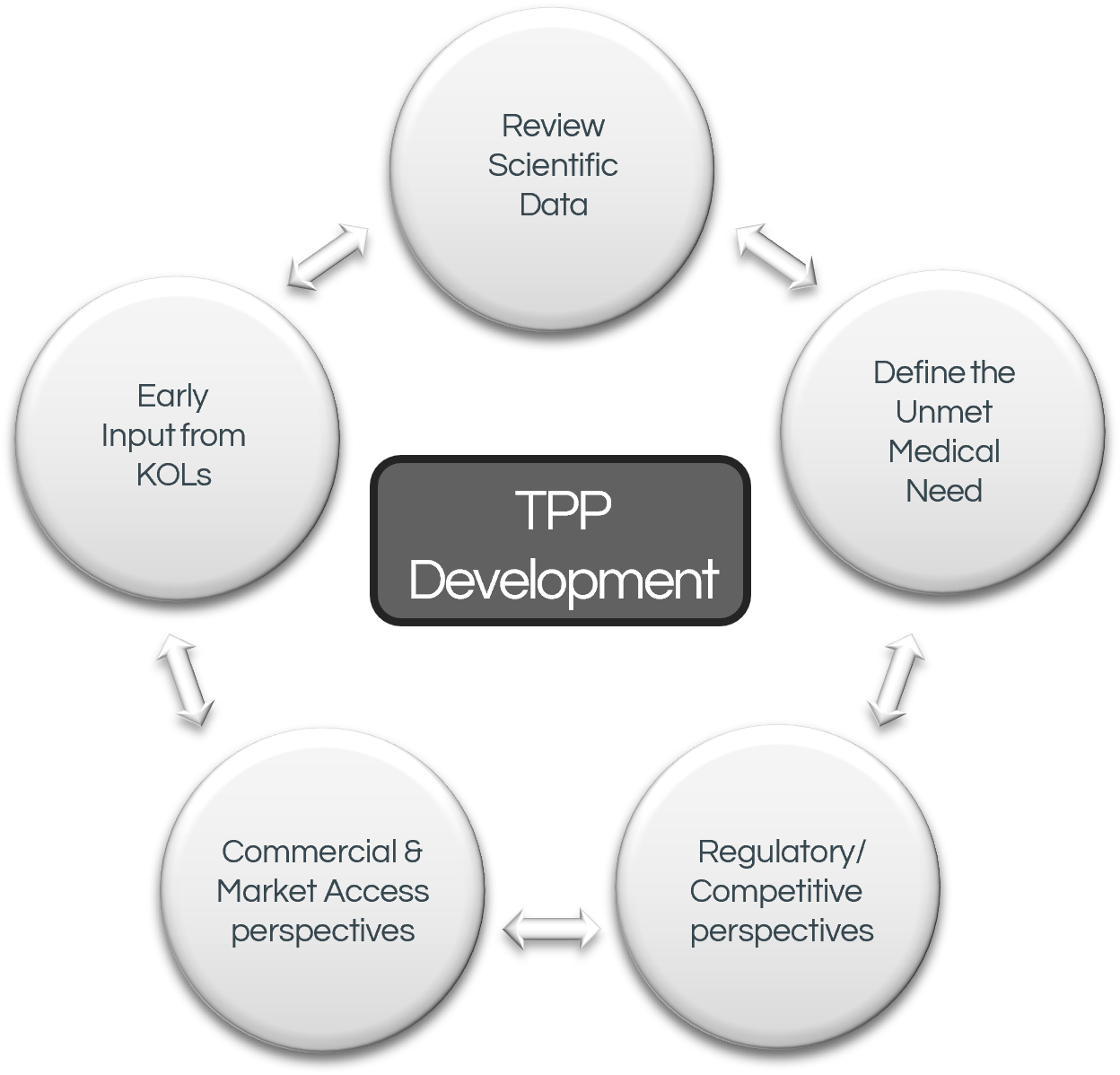

In larger organizations the TPP is usually created very early in development following a deep landscape assessment by a large cross-functional team ensuring input from multiple disciplines ranging from R&D to commercial functions, each with deep expertise in the relevant area. In this environment, the TPP is part of the integrated development plan, which undergoes thorough vetting by management before approval, and is a living document.

In the startup biotech environment, due to capital and human resource constraints, TPPs are often developed in a relatively superficial manner. This is more often the case if the approach is at the research or early non-clinical development stage. Here, teams often do not incorporate assessments of the added long-term value that comes from considering market positioning, patient access and the reimbursement landscape to underscore the estimation of early product valuations. A TPP taking these factors into account allows clearer assessment of the asset’s economic viability and makes it significantly more attractive for assessing investment potential. In addition, assessing the practical feasibility of achieving a TPP (by showing how data will be generated to support the proposed claims and to demonstrate a differentiated profile), needs to be considered in a stepwise manner through non-clinical and clinical plans. Thus the creation of the TPP and Development Plan are often best conducted in parallel.

Given these considerations, early creation of a well-thought-out TPP supported by a landscape assessment is invaluable and will arm the internal fundraising team with key knowledge from multiple functional aspects, adding credibility to their pitches. In addition, the associated landscape assessment can also provide the basics for creating future regulatory documentation around benefit-risk profiles and justifying study and program designs.

Partnering with a consultancy that can provide relevant deep expertise to supplement the knowledge of a client’s internal team and conduct a detailed landscape assessment will result in the development of a future-proofed and evidence-based TPP. Combining this with a logical development plan demonstrating how claims in this key document will be achieved with clear Go/No-Go stage gates will maximize the chances of successful funding.

Adnovate Clinical understands the importance of this exercise and has helped multiple early-stage companies, working flexibly with their internal teams to provide the deep expertise required to create the blueprints for fundraising, from which operational execution can reliably take place. Our approach is scientifically-driven, methodical, and evidence-based starting with the mechanism of action and target and biology of the disease.

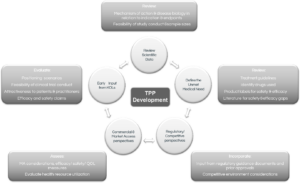

Analysis of the basic science enables evidence-based recommendations to be made on suitable indications. Research into pathophysiology, epidemiology and SoC within those disease states allows appropriate target populations and sub-populations to be identified. This information, in combination with analysis of the competitive landscape, enables likely future SoC (including the predicted future residual treatment gap) and safety/efficacy hurdles to be identified and the size of the addressable target population to be estimated. Regulatory expertise is used to assess the viability of the TPP and identify any routes for niche regulatory positioning (Orphan Drug Designation, accelerated review etc.).

During a project, Adnovate Clinical develop several TPP options, and will work with the client to align these with the company’s strategy and risk appetite to identify the key TPP to take forward. This can then be pressure-tested with clinical experts, payers and physicians.

The outputs generated from the landscape assessment that inform the TPP include multiple background sides, as well as literature searches, references, and database downloads. These can be used in future investor presentations as a basic knowledge repository to inform and justify future development plans, as well as in clinical and regulatory documents as the asset progresses through its life cycle.

Conclusions

A well-thought-out TPP and a development plan that supports this key document are essential for regulatory and commercial success in drug development. However, these documents also act to help outline and asses risk, detail cost and timelines, and give a clear road map for investment milestones, identifying the likely probability of success and giving confidence to potential investors. A comprehensive development package combined with a competitive but realistic TPP allows potential investors to fully appreciate the future value of an asset, increasing confidence and the likelihood of successful funding.

Adnovate Clinical has the requisite cross-functional expertise and experience to advise on the most appropriate indication and produce high-quality well-considered TPPs and development plans that not only maximize the chances of clearing regulatory hurdles, but also provide clear visualization to address future unmet needs and commercial success.

By taking a ‘skin in the game’ approach to fundraising interactions, the Adnovate Clinical team remain on hand to defend the recommended approaches during pitches and due diligence activities, giving management teams access to the expertise they need to convey credibility to future investors.

For more information please get in touch at: https://www.adnovateclinical.com/contact-us/

References

- Roche R&D presentation September 2023. Roche analysis of EvaluatePharma (data as of March 2023). Note, new molecular entities, including biologics.

- Roche R&D presentation September 2023. Note includes Phase 1b expansions for oncology, single arm Phase 2 and randomized Phase 2 studies.

- Global trends in R&D report, February 2023.

;)